Farewell Episode: Risk Parity Without Correlations

Never get into a committed relationship with assets' covariance. They're too unstable.

(Sample code attached at the end)

3 things we need for portfolio construction:

Correlation Matrix (ok somewhat predictable)

Volatility (ok somewhat predictable)

Ok so if expected returns is notoriously hard to predict, but you can somewhat predict volatility and correlations, what should the optimal portfolio be? Risk Parity! (not strictly true, but play along with me for now).

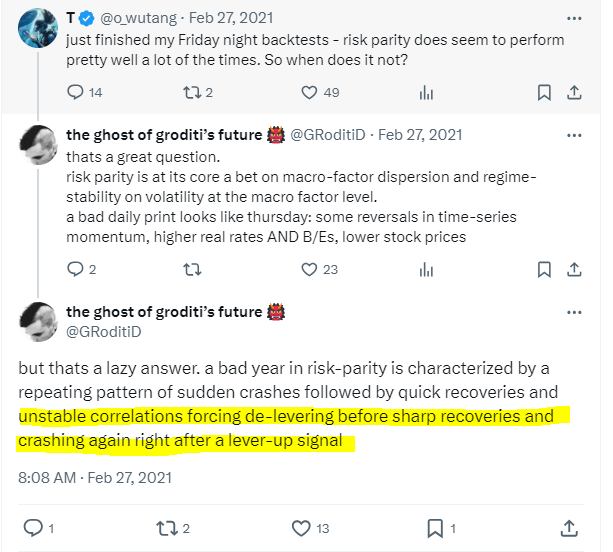

We all know the equity-bond risk parity has performed well due to the Fed printing money in the backdrop blablabla (boring). What's not boring is this tweet I saw:

Okay, so unstable correlation is apparently a thing (who would've thought the world is fat-tailed and non stationary), and that causes risk parity to underperform. Quite interesting that @GRoditiD framed risk parity as a bet on macro-factor dispersion; never thought of it that way tbh.

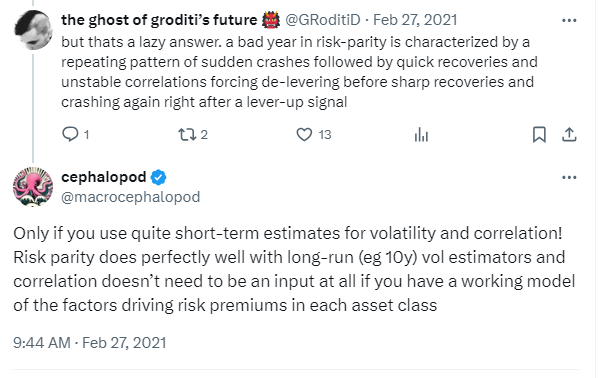

And @macrocephalopod came with a reply:

Interestingly @macrocephalopod argued for two things:

2) There's no need for correlation, if you can model the returns drivers in each asset class

Wait what? Correlation doesn't need to be an input? In this article we will explore that, and how do we implement this in practice, as well as some tips and tricks when modelling the assets' returns drivers.